After March 10, 2025 ▪

6

min at reading ▪

Bitcoin begins a decisive week after a significant fall, which trembles the market. Between macroeconomic uncertainties, interest rate voltage and technical indicators under pressure investors are exploring other movements. Despite the feeling of extreme fear, some signals indicate possible conversion. Here are the 5 main elements that need to be watched this week!

Bitcoin: Five key factors are absolutely watching this week

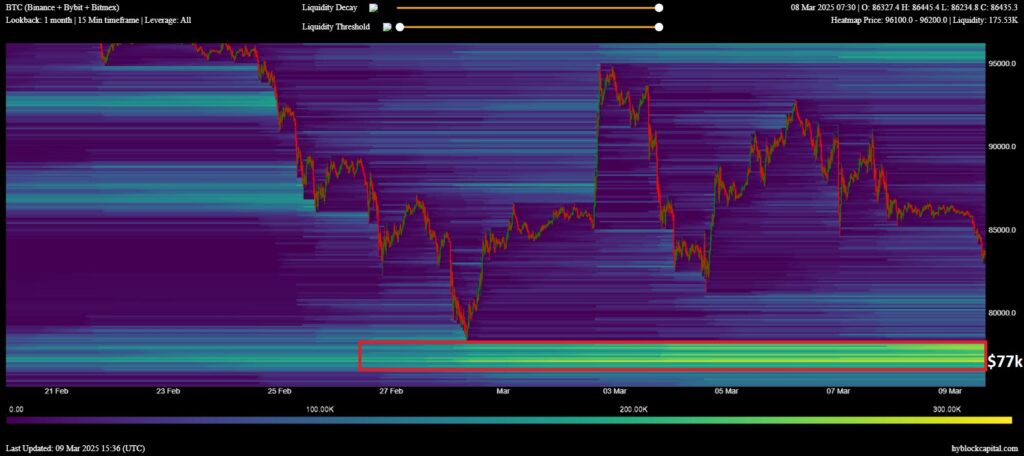

Bitcoin is on the razor thread this week and flirts with a critical threshold of $ 82,000, which could cause a huge wave of disposal. In order not to repair anything, this situation could highlight disturbing technical signals and certain pressures on the market.

1.

Bitcoin experienced a sudden decline, lost 14 % of its value per week and closed around $ 80,000. This download means the strongest weekly decline in dollars that have never been seen. Some analysts such as Kevin Svenson emphasize that BTC is at a critical level of their weekly parabolic tendencies.

Others, such as superbro trader, are considering a new origin to $ 78,000, while Cryptnovo insists on the importance of Prague $ 77,000 due to observed disposal. Despite this autumn, the consensus is between analysts that Bitcoin has not yet entered the lower market, but caution is fine.

2. Macroeconomics weighs on the market

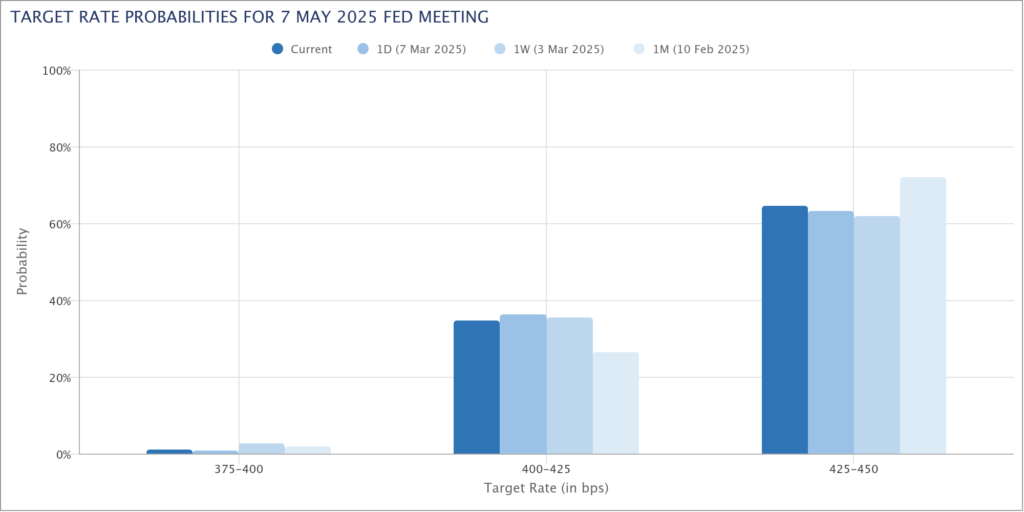

This week is also marked by the main macroeconomic publications in the United States, including CPI (Infi) and PPI (Production Price) indices. The latest inflation data has exceeded expectations and supported market uncertainty. The general feeling is a “risk”, causing investors to be careful.

The expectation of the federal reserve rate falls falls asleep, according to the CME Group in March only 3 % chance of money release. The forecasts of economic growth decrease in parallel and strengthen tensions on the financial markets.

3. Return to 2021?

Bitcoin could re -test lower levels, with several technical indicators aimed at $ 69,000 to $ 75,000. The “lowest forward prices” instrument developed by Timothy Peterson estimates 95 %that BTC will not descend below $ 69,000. Analysts are also monitored by other indicators such as a simple mobile diameter in 50 weeks ($ 75,560).

Arthur Hayes, the former CEO Bitmex, believes that if Bitcoins translate $ 78,000, another main support is $ 75,000, with increased volatility is expected to be approximately $ 70,000 and $ 75,000.

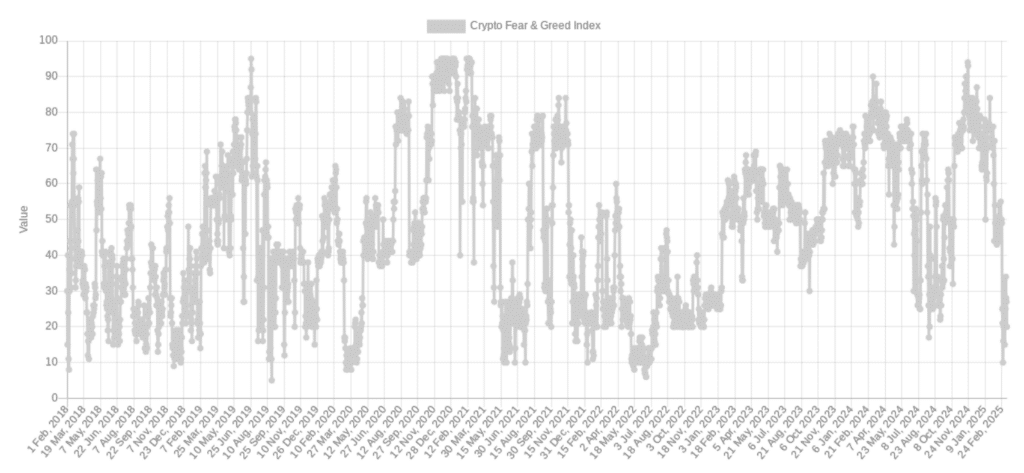

4. Historically low market feeling

The crypto index of fear and greed has reading “extreme fear” and rarely reach the level for three years. However, some investors, such as Anthony Pompliano, recall that this type of extreme feeling can prevent the bull conversion. He emphasizes that despite the extreme fear index, Bitcoin is 20 % higher than a year ago when it was in “extreme greed”.

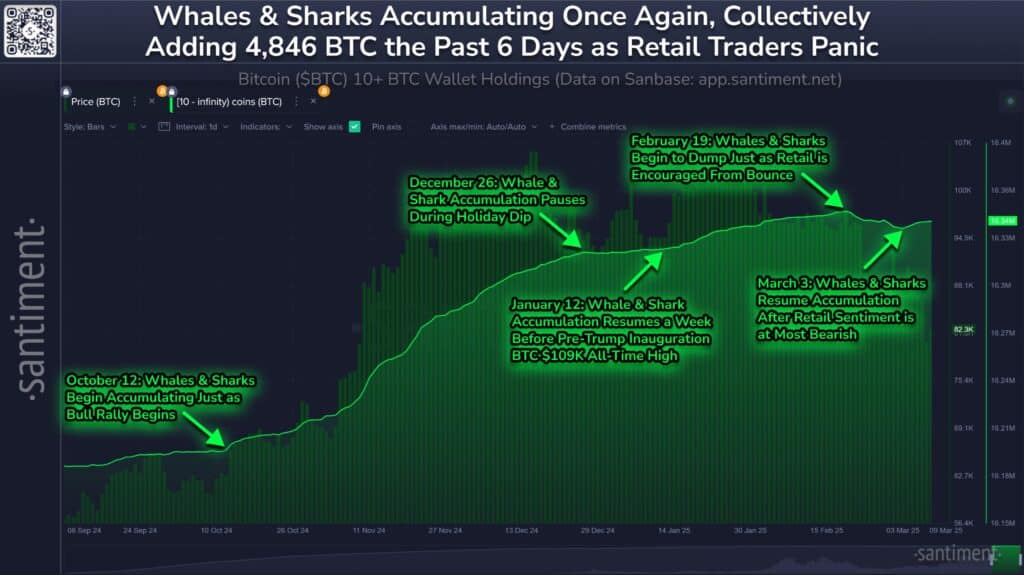

5. Bitcoin whales are buying

Despite uncertainty, a positive signal occurs: whales and sharks (investors with more than 10 bitcoins) will restore their purchases. According to Santiment, these large portfolios accumulated almost 5,000 BTC from 3 March to the period of sale between mid -February and early March. If this accumulation continues, the second half of March could appear about recovery.

Solution in the hands of Michael Sayl?

Michael Sylor recently offered a strategy at a recent White House Summit, focused on a $ 100,000 billion Bitcoin market, an explosive impact on its price. By strengthening the institutional acceptance and location of BTC as a reserve of the basic value, this vision could speed up demand and reduce the available offer.

If large companies and states massively adopt this approach, the shopping pressure could drive bitcoins far beyond its current summity. However, regulatory and macroeconomic challenges must be monitored.

Bitcoin will therefore exceed the period of strong volatility, such as the crypto market as a whole that has just lost $ 440 million. With increasing storage of whales and critical technical levels, this week will be decisive for the market trend.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.